Introduction

In the contemporary financial landscape, a person’s creditworthiness plays a pivotal role in shaping their ability to access loans and credit cards. At the forefront of this evaluation is the CIBIL score, a numerical representation of an individual’s credit history. When seeking financial assistance from banks or applying for credit cards, the CIBIL score is scrutinized to gauge the borrower’s reliability in repaying loans.

A higher CIBIL score is not only advantageous for securing loans with ease but also influences the approval process for credit cards. Conversely, a lower CIBIL score can pose significant challenges in obtaining financial assistance. This article delves into the importance of the CIBIL score and provides actionable strategies to swiftly enhance it. By understanding and implementing these strategies, individuals can navigate the financial landscape with confidence, unlocking opportunities for better loan terms and increased access to credit.

When you approach a bank for a loan or apply for a credit card, your creditworthiness is assessed through your credit score, known as the CIBIL score. A higher CIBIL score is advantageous, facilitating easier loan approvals and credit card applications. If you’re unfamiliar with the CIBIL score, it is a numerical representation of your credit history, reflecting how promptly you have repaid loans from various banks. Today, we will share some effective ways to boost your CIBIL score quickly.

Understanding CIBIL Score

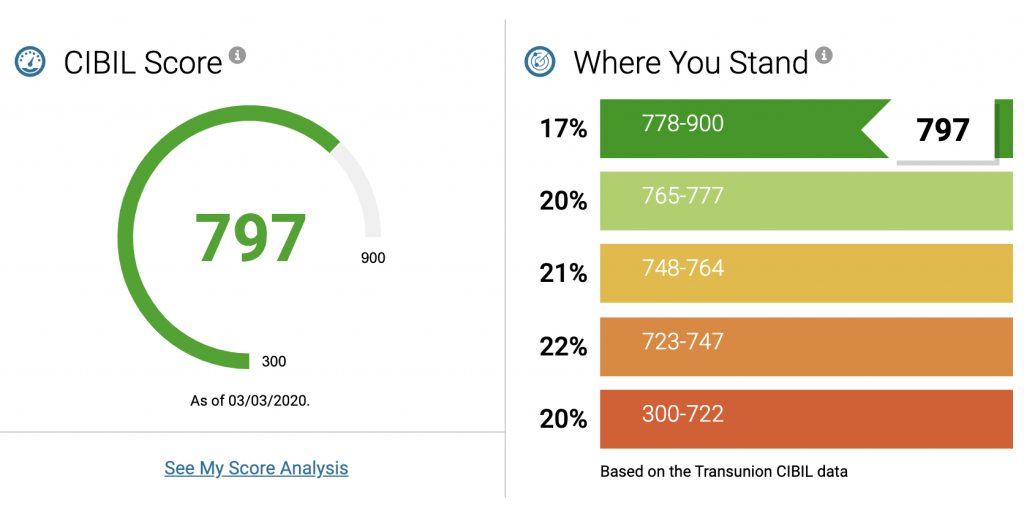

If your CIBIL score is below 700, you may encounter challenges in obtaining loans and credit cards. A good CIBIL score, preferably above 700, not only facilitates loan approvals but also helps in securing loans at lower interest rates. Let’s explore strategies to enhance your CIBIL score:

1. Regularly Check Your CIBIL Score

It is crucial to periodically check your CIBIL score. If you identify any discrepancies or unauthorized transactions in your credit history, promptly report them to prevent a negative impact on your score.

2. Timely Payment of Credit Card Bills

If you possess a credit card, ensure timely payment of your credit card bills. Late payments not only incur fees but can also adversely affect your CIBIL score. Paying your bills on time is imperative.

3. Timely Repayment of Loans

If you have ongoing loans, make timely repayments. Efforts to repay the loan amount before the due date can also contribute positively to boosting your CIBIL score.

4. Avoid Multiple Credit Card Applications

Applying for multiple credit cards can negatively impact your CIBIL score. Limit your credit card applications to maintain a healthy credit profile.

5. Responsible Credit Card Usage

Maintain responsible credit card usage by not exhausting your entire credit limit. Aim to utilize only 50% or less of your credit limit to demonstrate financial discipline.

By implementing these strategies diligently, you can witness a significant improvement in your CIBIL score within 1 to 2 months.

Check Your CIBIL Score with Ease

Now that you are aware of effective strategies to improve your CIBIL score, it’s essential to regularly monitor your score. Checking your CIBIL score is a straightforward process. You can visit CIBIL.com and use your mobile number and PAN card details to access your credit score. Additionally, payment apps like Paytm, GPay, and PhonePe also provide a convenient way to check your CIBIL score. Stay informed and take proactive steps to enhance your financial credibility.

Conclusion

In conclusion, recognizing the significance of a robust CIBIL score is crucial in today’s financial realm. Whether one is contemplating a loan or eyeing a new credit card, the CIBIL score acts as the key determinant of creditworthiness. A higher score opens doors to favorable loan terms, quicker credit card approvals, and even lower interest rates.

This article has outlined practical strategies to elevate your CIBIL score efficiently. From vigilant monitoring and timely bill payments to judicious credit card usage, each step contributes to building a positive credit history. By following these measures diligently, individuals can witness a tangible improvement in their CIBIL score within a relatively short timeframe.

Understanding how to check your CIBIL score, whether through dedicated websites like CIBIL.com or convenient payment apps, empowers individuals to stay informed about their financial standing. As we navigate the intricacies of the financial landscape, a bolstered CIBIL score becomes a valuable asset, enabling individuals to achieve their financial goals and secure their financial future.